The United Kingdom’s decision Thursday to exit the European Union did not immediately affect Americans’ confidence in the U.S. economy. Gallup’s U.S. Economic Confidence Index was -16 in three-day rolling averages recorded before and after the referendum. This might suggest that Americans are taking a wait-and-see approach before assessing the vote’s effect on the U.S. economy, or that Americans are simply unconcerned with matters across the Atlantic.

| Pre-Brexit (June21-23) | Post-Brexit (June24-26) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| U.S. Economic Confidence Index | -16 | -16 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GALLUP DAILY TRACKING | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

There is a great deal of uncertainty surrounding how the Brexit decision will affect the global economy in the future. Many investors reacted negatively, including in the U.S., where the Dow Jones industrial average fell 610 points the day after the vote. Economists’ opinions differ on what long-term influence the decision will have in the U.S.

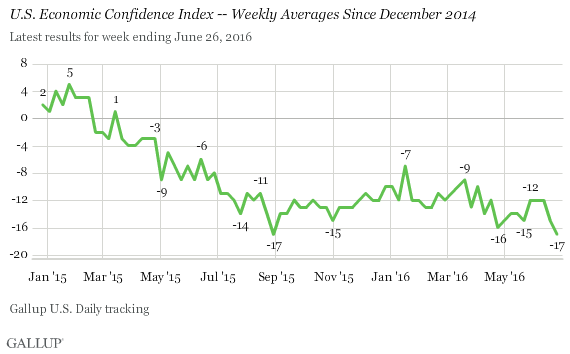

In the short term, Americans appear unfazed by the decision — at least concerning their views of the U.S economy — and they are about as confident in the U.S. economy as they were in the week before the referendum. Gallup’s U.S. Economic Confidence Index was -17 for the entire week ending June 26, including interviewing done partly before and after the Brexit results became known on Friday. Although this reading matches the low from the past year, the latest index reading is not markedly different from the -15 recorded in the previous week.

Confidence has been consistently negative for well over a year — similar to how it has been for most of Gallup’s tracking of the index since 2008. While the weekly averages in 2016 have fallen short of the positive ones recorded in late 2014 and early 2015, they are still well above many of the dismally low figures registered in the aftermath of the Great Recession.

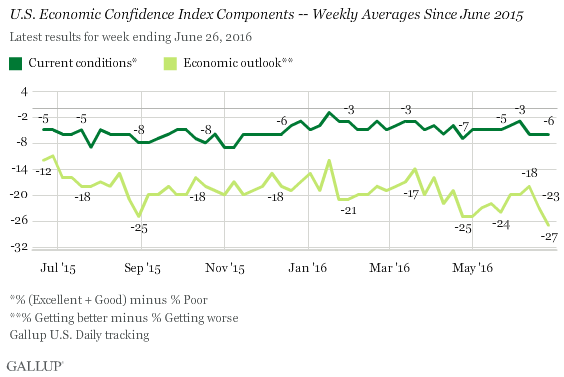

Gallup’s U.S. Economic Confidence Index is the average of two components: how Americans rate current economic conditions and whether they feel the economy is improving or getting worse. The index has a theoretical maximum of +100 if all Americans say the economy is doing well and improving, and a theoretical minimum of -100 if all Americans say the economy is doing poorly and getting worse.

For the week ending June 26, the current conditions score registered -6, consistent with the readings on this component over the past year. This latest score was the result of 24% of U.S. adults rating the current economy as «excellent» or «good,» and 30% rating it as «poor.»

Americans continue to be more pessimistic about the future of the economy. The latest economic outlook score of -27 was the lowest for this component since November 2013, based on 34% of U.S. adults saying the economy is «getting better» and 61% saying it is «getting worse.» This figure has declined slightly each of the past two weeks, accounting for the drop in the overall weekly index from -12 the week of June 6-12 to the most recent -17.

Bottom Line

Americans’ confidence in the economy might be unmoved for the time being, but that’s not to say it won’t change in the weeks to come. The public’s confidence has faltered after major political and economic events in the past, and the fallout from the Brexit might not have settled yet — particularly if it continues to affect U.S. stock values in the short run or hurts other aspects of the U.S. economy in the coming years. The referendum decision is literally foreign to Americans, and many might struggle to understand what it means.

Americans might be more likely to feel its effects on the behavior of their own stock market, which suffered in the immediate aftermath of the Brexit vote. But some argue that these are temporary setbacks and that the U.S. economy is resilient enough to weather any potential fallout from the U.K. — and could even stand to gain from it via lower costs for imports and gas.

These data are available in Gallup Analytics.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted June 20-26, 2016, on the Gallup U.S. Daily survey, with a random sample of 3,544 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is ±1 percentage point at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how Gallup Daily tracking works.

Expositores: Oscar Vidarte (PUCP) Fernando González Vigil (Universidad del Pacífico) Inscripciones aquí. Leer más

Una retrospectiva para entender los próximos cuatro años. Leer más

En la conferencia se hará una presentación de los temas más relevantes del proceso de negociación se llevó a cabo desde el 2012, así como del acuerdo de paz firmado entre el Gobierno colombiano y la guerrilla de las FARC a finales del 2016. Se analizarán los desafíos y las... Leer más

El Observatorio de las Relaciones Peruano-Norteamericanas (ORPN) de la Universidad del Pacífico es un programa encargado de analizar y difundir información relevante sobre la situación política, económica y social de Estados Unidos y analizar, desde una perspectiva multidisciplinaria, su efecto en las relaciones bilaterales con el Perú.

© 2026 Universidad del Pacífico - Departamento Académico de Humanidades. Todos los derechos reservados.